Choosing the right accounting software is crucial for any business. It can streamline operations and save valuable time.

Accounting software helps manage finances, track expenses, and generate reports. With many options available, selecting the right one might seem daunting. Each business has unique needs, and the right software should meet those specific requirements. Making an informed decision can improve efficiency and accuracy in financial management.

Understanding what features to look for and what your business needs can simplify this process. In this guide, you’ll learn how to identify the best accounting software for your business, ensuring it aligns with your goals and budget. Let’s dive into the key factors to consider and make this decision easier for you.

Identify Your Business Needs

Choosing the right accounting software starts with identifying your business needs. This critical step ensures you select a solution tailored to your specific requirements. Understanding what your business truly needs can save time and money.

Size And Type Of Business

Consider the size of your business. Small businesses might need basic features. Larger enterprises require more advanced functionalities. Think about the industry your business operates in. Different industries may have unique accounting needs. Retail, manufacturing, and services each have specific requirements.

Specific Accounting Requirements

Identify the specific accounting tasks your business performs. Do you need payroll management? Are you handling inventory? Look at features like tax preparation and expense tracking. Decide if you need multi-currency support. Consider integration with other software you use. Make sure the software meets regulatory requirements in your region.

Budget Considerations

Choosing the right accounting software can be overwhelming. Budget considerations play a key role in this decision. It’s vital to understand both initial costs and ongoing expenses. This helps in making an informed choice that aligns with your financial plan.

Initial Costs

The first thing to look at is the initial cost. This is the amount you need to pay upfront. Some software requires a one-time payment. Others offer subscription plans. Compare these costs. Check if the software offers a free trial. This helps you assess its features without a financial commitment.

Ongoing Expenses

Next, consider the ongoing expenses. These are the costs you will pay regularly. They can be monthly or yearly. Subscription-based software often has these expenses. Look out for hidden fees. These can include costs for updates or additional features. Calculate these costs to see if they fit your budget.

Key Features To Look For

Choosing the right accounting software for your business can be overwhelming. There are many options available, each with unique features. It is important to select software that meets your specific needs. Here are some key features to look for in accounting software:

User-friendly Interface

A user-friendly interface is essential for efficient workflow. The software should be easy to navigate. Look for a clean and intuitive design. This will save time and reduce errors. Employees should not need extensive training to use the software. Simple, straightforward menus and commands are ideal.

Integration Capabilities

Integration capabilities allow the software to work with other tools. Ensure it can connect with your existing systems. This includes CRM, payroll, and inventory management software. Seamless integration reduces manual data entry. It also helps maintain data accuracy. Choose software that supports API integrations for flexibility.

Security Features

Security features protect your financial data. Look for software with encryption to secure sensitive information. Multi-factor authentication (MFA) adds an extra layer of protection. Regular updates and patches are crucial for security. Ensure the software complies with industry standards and regulations.

Scalability And Flexibility

Choosing the right accounting software is crucial for your business. Two important factors to consider are scalability and flexibility. Your software should grow with your business and adapt to changing needs. In this section, we will discuss these aspects in detail.

Growth Potential

Your business will likely expand over time. Ensure your accounting software can handle this growth. Look for features such as:

- Multiple Users: Can you add more users as your team grows?

- Transaction Limits: Is there a limit to the number of transactions?

- Data Storage: Does it offer sufficient storage for your growing data?

These features are essential for a growing business. They ensure smooth operations without interruptions.

Customization Options

Every business has unique needs. Your accounting software should offer customization options. This allows you to tailor the software to your specific requirements. Look for:

- Custom Reports: Can you create reports that meet your needs?

- Flexible Invoicing: Can you customize invoices to match your branding?

- Integration Capabilities: Does it integrate with other tools you use?

Customizable features enhance the usability of the software. They ensure it fits seamlessly into your business processes.

| Feature | Importance |

|---|---|

| Multiple Users | High |

| Transaction Limits | Medium |

| Data Storage | High |

| Custom Reports | High |

| Flexible Invoicing | Medium |

| Integration Capabilities | High |

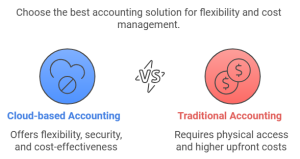

Cloud-based Vs. On-premises

Choosing the right accounting software is crucial for your business. One key decision is whether to use cloud-based or on-premises software. Both have their own advantages and can impact your business differently. Understanding their benefits will help you make the best choice.

Advantages Of Cloud-based

Cloud-based accounting software is accessible from anywhere with an internet connection. This flexibility allows you and your team to work remotely. Cloud systems update automatically, so you always use the latest features. They also offer better security since data is stored off-site. This reduces the risk of data loss due to hardware failure.

Cloud-based solutions often have lower upfront costs. You pay a subscription fee instead of a large one-time purchase. This helps manage your budget and cash flow. You can also scale the software easily as your business grows. Adding more users or features is simple and quick.

Benefits Of On-premises

On-premises accounting software runs on your own servers. This gives you full control over your data and how it is managed. You do not rely on an internet connection to access your software. This can be beneficial if your internet is slow or unreliable.

With on-premises solutions, you avoid ongoing subscription fees. You make a one-time purchase and own the software. This can be cost-effective in the long run. Some businesses prefer on-premises software for its customization options. You can tailor the system to meet your specific needs.

Customer Support And Training

Choosing the right accounting software is crucial. Customer support and training are essential factors to consider. They ensure you get the most out of the software and avoid potential issues.

Availability Of Support

Reliable customer support is vital. Check if the software provider offers 24/7 support. Look for multiple support channels:

- Phone

- Live chat

- Help desk

These options can help solve issues quickly. Verify the response time. Quick responses can save valuable time. Read user reviews about their support experience. Positive feedback indicates reliable support.

Training Resources

Comprehensive training resources help you understand the software. Look for:

- Video tutorials

- User manuals

- FAQs

- Webinars

These resources should be easy to access. Some software providers offer in-person training. This can be beneficial for your team. Ensure these resources are up-to-date. Outdated information can cause confusion.

| Support Feature | Importance |

|---|---|

| 24/7 Support | High |

| Multiple Support Channels | High |

| Quick Response Time | High |

| Positive User Reviews | Medium |

| Training Resource | Availability |

|---|---|

| Video Tutorials | Yes |

| User Manuals | Yes |

| FAQs | Yes |

| Webinars | Yes |

Read Reviews And Get Recommendations

Choosing the right accounting software is crucial for your business. One essential step is to read reviews and get recommendations. This helps you understand real-life experiences and expert insights. It can save you from costly mistakes and ensure you pick the best fit.

Customer Testimonials

Customer testimonials provide a glimpse into the software’s performance. Real users share their successes and challenges. These reviews can reveal how user-friendly the software is. They also highlight any recurring issues or bugs. Reading testimonials helps you gauge the software’s reliability.

Look for detailed reviews. Users often mention specific features they love or dislike. This can help you identify if the software meets your business needs. Testimonials also reveal the level of customer support provided. Good support can make a big difference in your experience.

Expert Opinions

Expert opinions offer a professional perspective. Industry experts test and review various accounting software. They provide in-depth analysis of features and performance. Experts compare different options and highlight the pros and cons.

Reading expert reviews can help you understand complex features. Experts often point out details that regular users might miss. They also provide insights on future software updates. Expert opinions can guide you towards the most efficient and reliable software.

Trial And Evaluation

Choosing the right accounting software can be a game-changer for your business. One critical step in making an informed decision is the trial and evaluation phase. This phase allows you to test various software options before making a commitment. Below, we explore the importance of free trials and demos, as well as how to test for fit.

Free Trials And Demos

Many accounting software providers offer free trials and demos. This feature is essential because it gives you a hands-on experience. You can interact with the software, understand its features, and determine its ease of use.

During the free trial, pay attention to:

- User interface and navigation

- Available features and tools

- Customer support availability

Here is a table summarizing some popular accounting software and their trial periods:

| Software | Free Trial Period |

|---|---|

| QuickBooks | 30 days |

| FreshBooks | 30 days |

| Xero | 30 days |

Using free trials can save you from investing in the wrong software. It allows you to explore the software without financial risk.

Testing For Fit

Testing for fit means evaluating whether the software meets your business needs. Different businesses have different accounting needs. A software that works for one may not work for another.

Here are some steps to test for fit:

- List your business requirements.

- Match these requirements with the software features.

- Check if the software integrates with your existing systems.

Consider these questions during your evaluation:

- Does the software handle your transaction volume?

- Is it scalable as your business grows?

- Are there any hidden costs?

Evaluating these factors helps ensure the software aligns with your business needs. This step is crucial for long-term satisfaction and efficiency.

Making The Final Decision

Choosing the right accounting software is a crucial step for any business. The final decision can impact your financial management and overall business efficiency. You’ve done the research, compared features, and narrowed down your options. Now, it’s time to make the final decision.

This section will help you weigh the pros and cons and run through a final checklist. These steps ensure that you make an informed choice. Let’s dive into the details.

Weighing Pros And Cons

First, list the pros and cons of each software option. This helps you see the bigger picture. Consider aspects like cost, ease of use, and customer support. Also, think about integration with other tools you use.

For instance, one software might be cheaper but lack advanced features. Another might offer excellent support but at a higher price. Weighing these factors can clarify what’s most important for your business needs.

Don’t forget to consider the future. Your business will grow. Can the software scale with you? This foresight can save you time and money later.

Final Checklist

Before making the final decision, run through a checklist. This ensures you haven’t missed any critical details. Here’s a simple checklist to follow:

- Does the software meet all your essential requirements?

- Is it within your budget?

- Does it integrate well with your other tools?

- Is the customer support reliable and accessible?

- Is the software scalable for future growth?

- Have you read reviews or sought recommendations?

Going through this checklist can help confirm your choice. It can also highlight any last-minute concerns. Address these concerns before making the final decision.

Frequently Asked Questions

What Features Should Accounting Software Have?

Accounting software should have invoicing, expense tracking, payroll, and financial reporting features. Integration with bank accounts and other apps is also essential.

Is Cloud-based Accounting Software Better?

Cloud-based accounting software offers accessibility, automatic updates, and data backup. It’s suitable for businesses needing remote access and scalability.

How Do I Choose The Right Accounting Software?

Consider your business size, budget, and specific needs. Compare features, user reviews, and ease of use before deciding.

Can Accounting Software Handle Tax Compliance?

Yes, many accounting software solutions offer tax compliance features. They help automate tax calculations and generate necessary tax reports.

Conclusion

Choosing the right accounting software helps your business run smoothly. Consider your needs and budget first. Look for user-friendly features. Read reviews to see what others think. Try demos to test the software. Don’t rush your decision. The right software will save time and reduce stress.

It will also help you keep accurate records. This will lead to better financial decisions. So, take your time and choose wisely. Your business deserves the best tools to succeed.